All of the following ads are real and unaltered, so don't blame us. We weren't there when they were made, and in some cases the entire insane thought process that went into creating them has been lost to history. Maybe they made perfect sense at the time?

Maybe. But it's really hard to see how even our parents and grandparents didn't get nightmares from ...

#13. Three-Legged Dingo Boots

vintageadbrowser.com

vintageadbrowser.com

The Message:

Here are some boots that you should buy, because famous people wear them. Three of them.

The Horror:

Wait, what?

Yes, amazingly, the fact that this ad stars a pre-murder O.J. Simpson is the second-creepiest thing about it. And you can squint and try to read the text all you want -- it makes no reference whatsoever to the fact that their spokesperson has three legs. There's no cute slogan like "Boots so comfortable, you'll wish you had another foot!" Nope. It's like some guy in the art department just said, "Eh, I don't like how you can't really see the chair, let's just add another leg to fill that space."

We know what you're thinking: "Cracked, this is obviously a subtle 'big dick' joke. 'Third leg?' Get it?" But, no, it turns out this was a whole campaign they did with various celebrities, some of whom are women:

eBay

eBay

Like, uh ... this famous lady right here.

But O.J. seems to be the most frequent star of the "Third Leg" campaign, which apparently lasted for years. Note how his afro shrinks as he gets more comfortable with his new appendage:

The picture in that third ad would have been perfect for the cover of his book.

Please don't blame us for the inevitable nightmare in which O.J. is running after you, in the dark, those three boots pounding down the pavement after you with a noise like a wounded horse.

#12. Lord West Suits Will Impress Your 7-Year-Old Date

vintageadbrowser.com

vintageadbrowser.com

"I like my women like I like my code names: 007."

The Message:

Women of all ages dig men in tuxedos!

The Horror:

According to the text, this dinner suit is for "sophisticated traditionalists," a euphemism we weren't previously aware of for "child molesters." Because there's no other way to interpret this picture. That's not tenderness on their faces. That's hunger. If you told us that they're a father and daughter, that would only make it creepier.

And it turns out that this is only the worst example in a whole series of ads associating little girls with selling tuxedos.

eBay

eBay

The style is best described as Godfather meets Lolita.

Can you imagine the pitch meeting that led to this campaign? Picture Don Draper from Mad Men standing before his clients, selling them on this idea:

"Class. Elegance. Making out with little girls. These are the values your company represents."

"Did ... did you say 'making out with little girls,' Don?"

"Yes," replied Don with perfect confidence.

"OK, just making sure."

Sitting at the end of the table, Peggy looks at Don and smiles. He did it again.

#11. Man in Tuxedo Carefully Considers Naked Child

library.duke.edu

library.duke.edu

"Told you it was bigger. Now pay up."

The Message:

Regular soap sinks in the bathtub, causing children to take longer in washing themselves and their fathers to get angry and spank them. Prevent child abuse by buying Ivory Soap -- it floats.

The Horror:

OK, they're clearly just fucking with us at this point. Remove the text and the message becomes clear: "In the old days, child predators used to dress way better than they do now." But let's put the pedophilia overtones aside for the moment and examine the text.

Was the elaborate scenario described under the picture (involving childhoods ruined by non-floating soap) really such a common problem in the '20s, or was this based on the painful personal experiences of whoever commissioned this ad? We're betting on the latter option. Note that the father's body language doesn't say "I'm going to spank you" -- he's clearly pondering which part of the kid's body to break first.

"Maybe the 28th trimester isn't too late for an abortion."

#10. "Are You Sure I'll Still Be a Virgin?"

thesocietypages.org

thesocietypages.org

"If you didn't think band camp counted, I don't see why you'd think this would."

The Message:

Don't worry, teens, you can use Tampax tampons without losing your virginity.

The Horror:

Be honest: How many of you looked at this picture and immediately recognized it as a Tampax ad? And how many looked at it and thought it depicted a teenage girl being sexually propositioned? It's not just us, is it?

This ad would have looked 90 percent less sordid if both people involved were clearly visible. Instead, the second teenager is for some reason sitting on the floor of the porch with her back to us, so we can't see how young, or scared, she is. But, of course, all of that is purely from our own depraved imagination. The real ad is simply about two teenagers debating whether or not inserting a tampon counts as sex.

#9. Escaped Convicts Love Revell Authentic Model Kits

vintageadbrowser.com

vintageadbrowser.com

"Is this the new plan, boss?"

"I've spent all day plotting against Superman; this is 'Lex Time'."

The Message:

Hey kids! Check out these sweet model kits!

The Horror:

There's only one possible scenario in which this picture could have come to exist: The photographers were getting ready to shoot this ad when they realized that the boy who was supposed to be holding up the models in the picture never showed up for work. Panicking, the man from the ad agency looked around the studio.

"Dmitri, can you come here for a second?" he said to the guy who fixes the lighting. "Stand here and hold this model. Yes, that's great. You'll play the boy in this ad."

"But sir," said the photographer, "Dmitri was just released from jail. In fact, he's still wearing the prison jumpsuit."

"No, no, he's perfect. Look at him. Look at that childlike innocence in his face."

"Could you open the top button maybe, show a little chest hair?"

"Perfect."

#8. Our Competitors = Surgical Ass Torture

vintageadbrowser.com

vintageadbrowser.com

"Don't worry, sir, the gloves are just to establish atmosphere."

The Message:

Using cheap toilet paper can lead to medical complications.

The Horror:

... which in turn can lead to rubber-gloved hands inserting clamps in your anus. Better play it safe and go with Scott Tissues.

This attempt to traumatize customers into buying their product with threats of anal torture was part of a whole marketing campaign created during the Great Depression in which Scott Tissues' slogan went from "Wipe your butt with us" to "Wipe your butt with us, or die in a world of asshole pain."

Of course, it was all bullshit: There's no such thing as "toilet tissue illness," it was just a thing they made up to convince people to keep buying tissues at a time when they were lucky enough if they had a toilet.

#7. "Before You Scold Me, Mom ... Maybe You'd Better Light Up a Marlboro"

deceptology.com

deceptology.com

The Message:

Before you beat your baby for stealing your favorite hat, have a cigarette and relax yourself. Then beat the baby.

The Horror:

How many times did this months-old child have to be punched before it learned to pick up the Marlboros and offer them to mommy to calm her down? If that's not the saddest thing you've imagined all week, you're dead inside. This is actually one in a series of ads from the '50s, back when Marlboro was targeting mommies instead of rugged cowboys. Sometimes the babies actually seem to be guilting their moms into smoking more.

tobacco.stanford.edu

tobacco.stanford.edu

"You turned me into an addict when I was a fetus, now deal with it."

Oddly enough, the version of this ad aimed at fathers doesn't involve scolding, but a pompous baby in a basket defending daddy's rather feminine cigarette tastes (note the reference to "beauty tips" at the bottom).

tobacco.stanford.edu

tobacco.stanford.edu

This is the kind of debate babies have all the time.

Two people have suffered serious burns and some homes have been engulfed by the fire.

Two people have suffered serious burns and some homes have been engulfed by the fire.

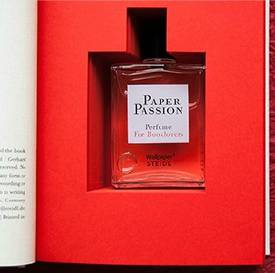

Paper Passion fragrance by Geza Schoen, Gerhard Steidl, and Wallpaper* magazine, with packaging by Karl Lagerfeld and Steidl.

Paper Passion fragrance by Geza Schoen, Gerhard Steidl, and Wallpaper* magazine, with packaging by Karl Lagerfeld and Steidl.